DafriBank is an all encompassing digital bank to serve as an electronic payment platform for digital entrepreneurs and traders

What Is Digital Banking?

What Is DafriBank (DBA) ?

DafriBank or The Digital Bank of Africa (DBA) is a borderless digital bank specifically built to serve as an electronic payment gateway system for digital entrepreneurs and merchants. DafriBank addresses the banking needs of Africa’s growing digital entrepreneurial class — a niche that has been largely ignored by the traditional banks. Being ‘borderless’ means anyone with access to the internet anywhere, can open and operate DafriBank account and other products offered by the bank. This revolutionary digital bank project will also target the unbanked and underbanked in Africa.

DafriBank's upcoming STO will be facilitated by DafriExchange which is set to commence operation in the fourth quarter of 2020. Every DBA holder and prospective DBA investors are required to open an account on DafriExchange which will have DBA as its native tokens and will be used for fee payments within the DafriExchange will also be integrated into the banking processes of DafriBank. The platform will redefine how exchanges operate by attracting more traders via our various product offerings. We will expand the pool of participants by fostering greater market liquidity thereby contributing to its overall growth

What Are the Benefits of DafriBank (DBA) ?

DafriBank offers a number of benefits for both consumers and business owners. Here are several:

- Access. With both desktop and mobile access to your bank accounts available, digital banking means you’re not beholden to bank hours to manage your finances.

- Better rates and lower fees. With online banks driving fees down, consumers have choices beyond their local brick-and-mortar financial institutions. It’s easy to compare rates and fee structures to find the best bank for your needs.

- Equity. Upstart online banks level the banking access playing field by reaching unbanked and underbanked communities that rely heavily on mobile phones but may not have access to physical bank branches.

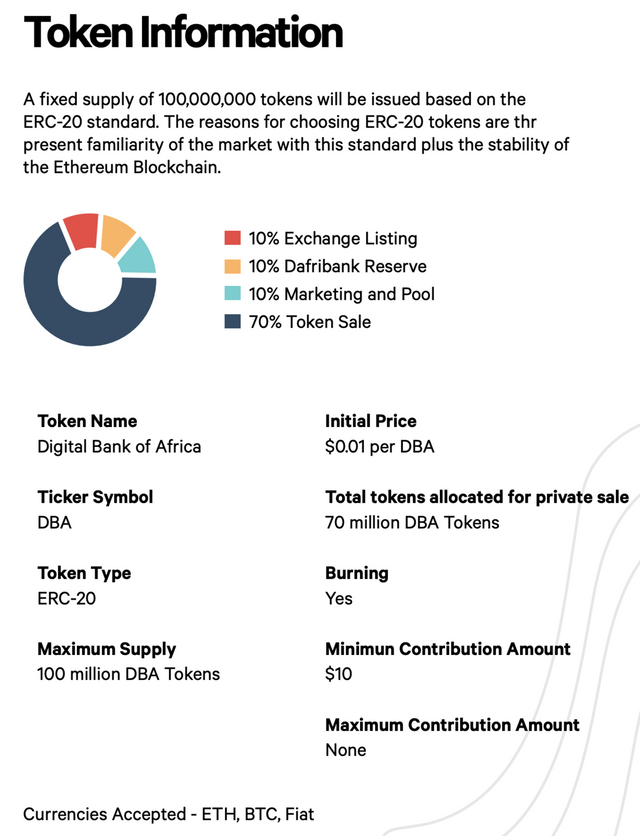

token information

the token is supported by DafriGroup’s daughter companies that cut across multiple industries including Banking and Finance, hospitality, real estate, and many more. These companies are all based on fully developed models and even without cryptocurrency are profit magnets in their own right. The DBA token is listed on LBank Exchange at 21:00 (UTC+8) on November 5, 2021, investors who are interested in DBA investment can easily buy and sell DBA token on LBank Exchange.

DBA already listed in Coinmarketcap, Coingecko, and in top exchanges at $15 but we can purchase it today at the launchpad in Latoken, ProBit, P2PB2B at $1.8 only.

“DafriBank Digital is a strong and stabilizing presence in the markets and regions in which They operate, providing inflows vital to immigrants and central banks alike. They work closely with regulators and central banks in this highly regulated industry to lead in compliance and provide innovative products that are affordable and accessible to customers

With the world fast embracing the internet buzz in virtually every aspect of life; it will be no exaggeration to state that in the next few years, DafriBank will give most of the Deposit Money Banks in the continent, a run for their money. The excitement is real particularly amongst digital entrepreneurs who may have found a home in the bank that does business for them in the speed of light.

Read More

- Website DafriBank: https://dafribank.com/

- Telegram group: https://t.me/DBATalk

- Facebook: https://www.facebook.com/DafriBank/

- Linkedin: https://www.linkedin.com/mwlite/company/dafribank-limited

#DafriBank #DafriBankDigital #OpenBanking #DigitalBanks #DigitalPayment #OnlinePayment #PaymentSolutions #CrossBorderPayment #DigitalEntrepreneurs #InvesInAfrica #Bitcoin #InstantMoney #InstantPayment #eWallet #Binance #MobileMoney #DigitalMoney #CryptoBank #Forex #Foxcampaigns

No comments:

Post a Comment