Cryptocurrency combats and solves this problem. With cryptonized assets, you remove the need for security validation and any involvement from third-parties. As a result, transactions are fast, significantly lower in fees (or sometimes free), and extremely secure as transactions are recorded and verified on the blockchain. This potential has tremendous impact when funds are required immediately.

Central to the Coinvest ecosystem is the COIN token; a cryptonized asset and network access token which enables holders to execute smart contract investment transactions or purchase products and services from ecosystem partners. COIN is a store of value, unit of account, record of investment, and the primary means of exchange used to pay for the execution of all smart contract code in the Coinvest ecosystem. More generally, COIN represents stake in the Coinvest protocol, and is the voting currency for all proposed protocol changes by the community.

To create virtual portfolios on the Coinvest platform, users fund investment trades with the COIN token. Upon executing a sell order, the smart contract returns the invested funds and any profit using COIN tokens. COIN token losses as a result of depreciating portfolio value will remain in the COIN reserve.

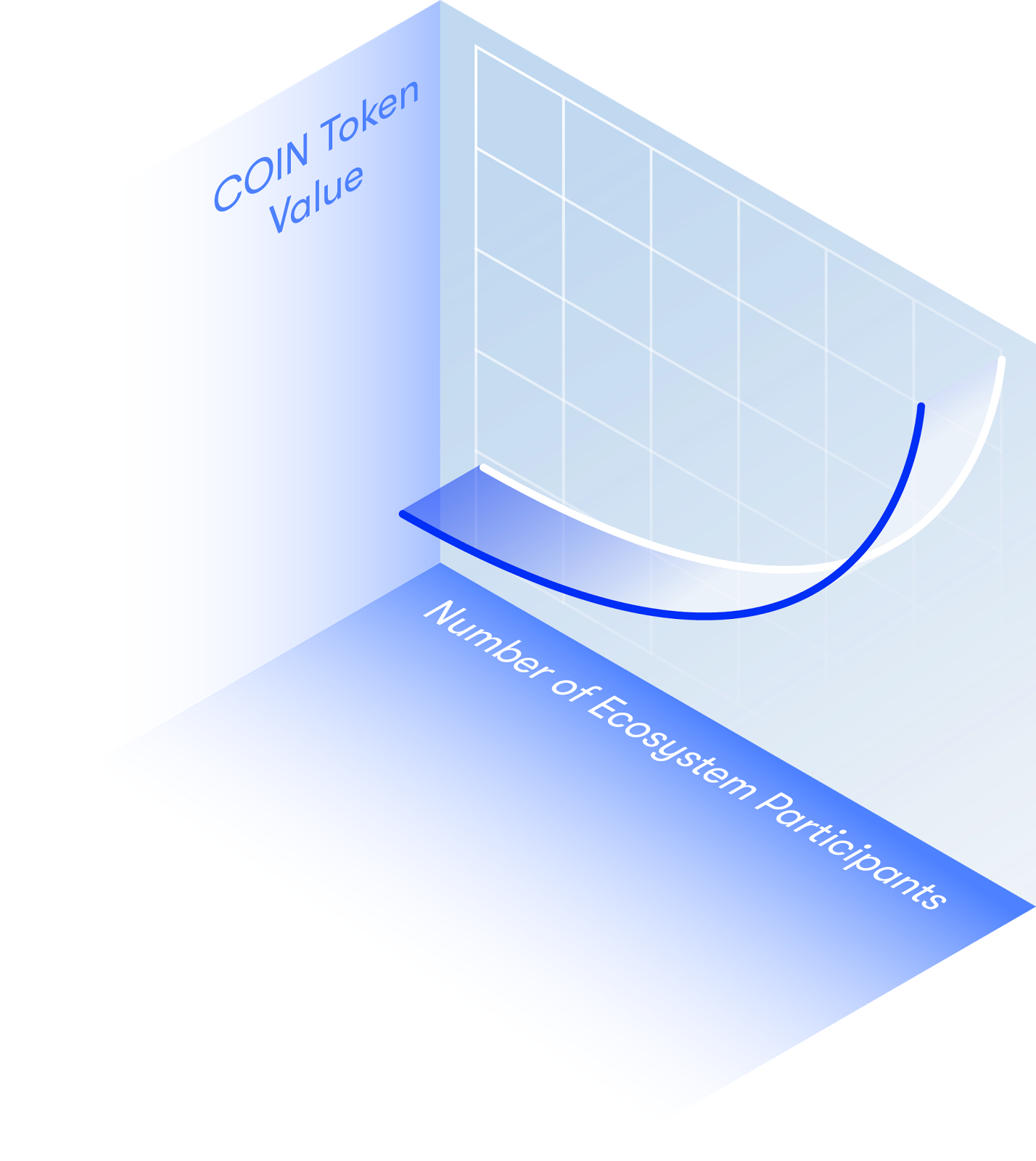

As the usage and adoption of the COIN token increases, the token holder’s investment power and overall asset value appreciates in return. Amongst its investment goals, Coinvest has a fiscal responsibility to increase COIN asset holder value. The company’s plan to achieve this includes:

- Strictly manage the creation and distribution of all COIN token assets available in the market

- Drive the creation of new programs, partners, merchants, and businesses that accept COIN token assets as a general payment or investment method

- Evangelize and drive the adoption of COIN token assets as a defacto cryptonized asset across the asset management industry and companies in the world

- Certify accredited companies that accept COIN token assets

Please Note: Coinvest and the COIN token does not guarantee profit sharing, dividends, or make any commitments on payouts and returns for token holders. The COIN token does not represent voting rights or ownership within the company.

COIN Token Standard

Many service industries are led by older incumbents that are new to blockchain technology. As a result, convenience and simplicity are necessary in all applications and blockchain related use-cases. Coinvest has taken these factors into consideration upon developing its platform, token, and overall product roadmap. Ultimately, solidifying Ethereum as the platform of choice for its token issuance strategy. With the community’s large and extensive support, Coinvest and the Coinvest protocol can ensure alignment with the latest developments and future roadmap for the Ethereum platform.

Ethereum is an open-source platform that facilitates the development of next-generation decentralized applications. Smart Contracts are a way of transporting anything of value — money, shares or data — without an intermediary. Thus enabling additional functionality to allow protocols to self-administer and self-execute specific instructions based upon conditions pre-programmed into the contract itself.

Harnessing an already well-established standard and blockchain like Ethereum makes COIN token a robust, secure, and high performing asset.

COIN Protocol and Smart Contracts

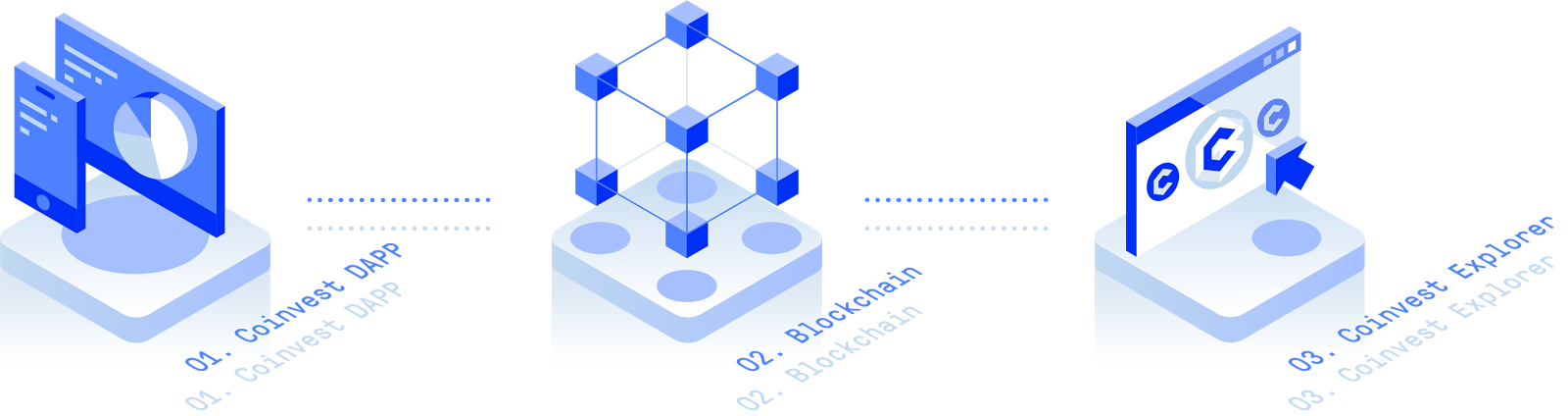

The Coinvest protocol is the heart of the platform while the smart contract functions contain logic that is executed when a token exchange, transaction, funding, and distribution occurs. The protocol can be accessed directly using the following contracts:

- Token Offering Contract (Pre-sale and Crowdsale Functions)

The pre-sale and crowdsale functions contain details and actions specific to the public token offering. This includes, but is not limited to the ability to purchase tokens and variables such as initial token price, discount rates, and more. The COIN token crowdsale variables are based upon the details outlined in the crowdsale section of this whitepaper.

- Investment Contract (Invest and Liquidate Function)

In the event of an investment, this function will execute, confirm, and anchor investment data to the blockchain. This protocol is also referred to as InvestChainᵀ ᷟ below. Additional variables specific to this use are recorded to the blockchain for record history and smart contract execution. Investment portfolios require a full deposit of COIN approved by the user, and sent by the DAPP to the smart contract. The funds are held by the Investment Contract until they are sold and withdrawn by the user at a later date (initiated through the Coinvest or partner DAPPs). Thus guaranteeing non-custody of the funds by a human body throughout the entire investment process.

The liquidate function contract handles the distribution of the fee schedule when the <sell> function has been initiated. The distribution supports the core Coinvest DAPP as well as custom DAPPS created and operated by others.

- Oracle Contract (Oraclize Function)

The Oracle contract will use Oraclize to frequently update market prices of the different cryptonized assets on the Investment contract.

- DAO Contract (Future)

The DAO contract will be implemented in the future and will allow all COIN holders to vote in new contracts to replace old ones. To begin with, these contracts will all be combined, disallowing the owner wallet the ability to switch out contracts with no approval while providing maximum security. However, contracts will be split up and put under DAO control to enable easy updates.

- User Database Contract (Future)

This contract saves all investment data on the holdings of each user. Once the DAO is created, compartmentalizing this contract from the Investment contract will allow updates of the Investment contract without affecting users.

All data in all cases above can be validated by the Ethereum network nodes.

Coinvest InvestChainᵀ ᷟTechnology

The COIN protocol utilizes InvestChainᵀ ᷟ, a technology created by Coinvest that anchors transaction data to the blockchain. In other words, provides a receipt of investment history for each on-chain trade. This receipt provides irrefutable proof of the investment data recorded at a specific time. Thus, preserving data integrity and increasing overall trust in the industry. Each receipt contains the following elements:

- Buy timestamp

- User wallet address

- Index name

- Cryptonized asset name(s)

- Cryptonized asset price(s)

- Cryptonized asset allocation

- Amount invested

- Sell timestamp

To provide complete trust and transparency, Coinvest will also create tools to validate these receipts, as open-source components for commercial use for the public. (Similar to cryptocurrency explorers, transaction data can be retrieved by way of different variable)

Coinvest will also develop API’s that enable partners in the COIN token ecosystem to accept the COIN token as a method of exchange AND provide complete transparency and validation to their users as well.

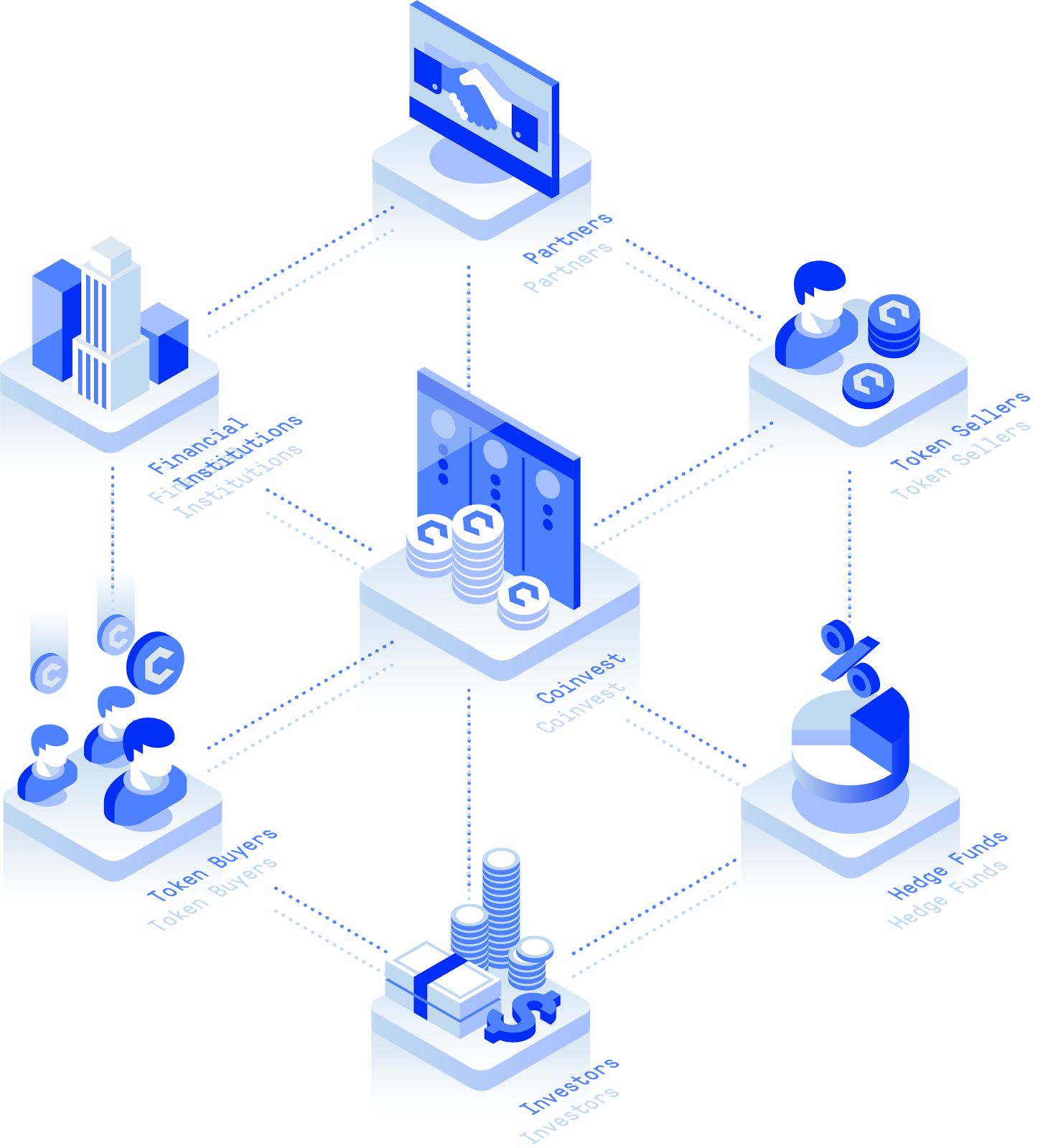

COIN Token Ecosystem

The COIN token ecosystem consists of many parties including, but not limited to, token buyers, investors, fund managers, financial institutions, partners, token sellers, etc. creating an equal exchange of buyers and sellers. It is a community that utilizes COIN as a means of support for its members and community.

Coinvest has allocated 10% of its total token supply specifically to distribute and develop the ecosystem. All in an effort to encourage and drive:

- The adoption and use of the Coinvest protocol

- Removal of centralized intermediaries and unnecessary third-parties from the investment process

- Transparency, trust, and reduced costs / fees

- Increased speed, availability, and frequency of investments to all end-users

As more participants join the ecosystem, the community rapidly increases in size through network effects. As the overall ecosystem grows, transaction volumes increase requiring the need for COIN token purchases to fund smart contract execution. As transaction volume increases, trade revenue increases which support buybacks of COIN to replenish the COIN reserve. In turn, the value of the COIN token will appreciate organically through demand. But most importantly, community transactions increase and become perpetual.

We now live in a digital age where it’s time to establish new protocols for funding across all industries and verticals. Protocols that are fast, secure, completely transparent, and borderless. Cryptonized assets and smart contracts will inevitably help redefine old business practices and resolve use cases that are slow, expensive, lack trust, and benefit central authorities. Moving forward, Coinvest will drive the Coinvest protocol as the new protocol and default mechanism for investing in cryptonized assets.

For more information, please visit our website at http://coinve.st.

Join our Telegram to join our community conversations or say hi to us at any of the channels below:

- Telegram: https://t.me/CoinvestHQ

- BitcoinTalk: https://bitcointalk.org/index.php?topic=2381017.0

- Facebook: https://www.facebook.com/CoinvestHQ

- Twitter: https://www.facebook.com/CoinvestHQ

- YouTube: https://www.youtube.com/channel/UCX-pE6nXFg3uK2_cMQ5n6jA

- GitHub: https://github.com/CoinvestHQ

- Medium: https://medium.com/@CoinvestHQ

- Reddit: http://reddit.com/r/Coinvest

- Email: hi@coinve.st

- Authorized by: willi dimuka

- https://bitcointalk.org/index.php?action=profile;u=1752966

- My ETH: 0xA00647621A4256eC0fcCca85253d06b61Fc88D5c

No comments:

Post a Comment