Leveraging Blockchain Technology and Evareium Tokens

Our Application into Private Equity Real Estate through Digital Assets, Smart Contracts, and as a Real Estate Currency for Transactions

Generally speaking, there are a number of issues faced by investors looking into the real estate sector as an asset class to preserve and grow wealth, and earn additional income. The buying and selling of real estate assets usually faces a number of issues:

- bureaucratic;

- failure to provide the appropriate levels of transparency;

- inaccuracy of information regarding everything from size of the property in question to additional costs, such as service/community fees, and municipal/property and transfer taxes;

- fraudulence by nefarious operators in the market;

- questions concerning the quality of the asset — particularly construction, mechanical, electrical and plumbing systems;

- management of the asset which carries potential unforeseen cost and time burdens; and,

- accurate title deed rights and other issues around record-keeping.

Not to mention the actual scope of opportunities in the market is narrower since the more lucrative real estate sub-sectors are beyond the reach of individual investors and these sub-sectors in question require another layer of knowledge, expertise and due diligence.

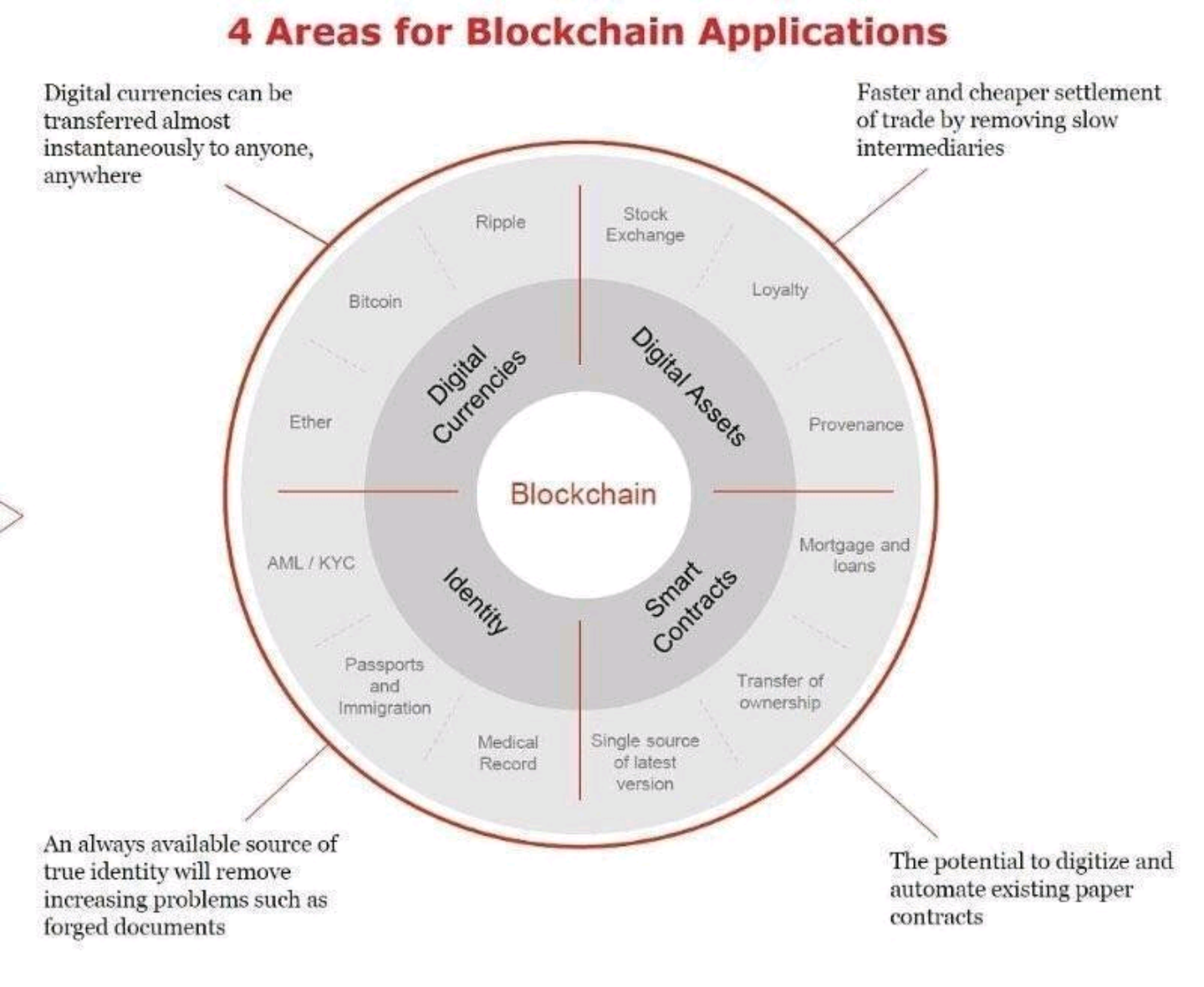

Leveraging and incorporating blockchain technology into the acquisition and management of these assets can provide a significant value uplift by expediting transactions, reducing or eliminating the paper trail (See Smart Dubai 2021initiative) and improving the accuracy and immutability of record-keeping.

Furthermore, the tracking and ownership verification process in relation to transactions and transferring property deeds, along with access to such information for prospective tenants to ensure they are dealing with the proper counterparties, raises in confidence in local property markets and reduces the instances of deceit and embezzlement.

We aim to leverage the benefits presented by blockchain technology, not only as a source of equity crowd funding for deployment into attractive assets (the EVM token), but also incorporate the technology in terms of:

- a utility token, EVT as the underlying token attached to transacting in relation to acquired assets and,

- applying it to the building monitoring, operating and management system to extract greater management and energy efficiencies, thus reducing costs.

EVM Token by Evareium

The Evareium investment token, EVM, is a tangible asset-backed token acquiring real estate, principally in Dubai and the broader United Arab Emirates, to carry out building remediation, energy savings and incorporate blockchain technology into the operation, monitoring and management of the real estate assets with the goal of creating a portfolio of Smart Buildings, with disciplined private equity principles as the foundation of the strategy.

We are not targeting residential or large office towers, but more select real estate sub-sector opportunities that are acquirable be leveraging the private equity structure of capital pooling and deployment. The Evareium sub-sector focus includes: industrial assets, hospitality and short-stay oriented operations, small targeted retail, academia, leisure and energy savings contracts for third-party landlords where we extract returns from the cost savings generated.

Investors accrue benefits from the economic interests of the assets/investments — investment returns generated from the acquisition of the portfolio, rental yields generated and gains on the eventual disposal. EVM’s value accretion basis is a fundamental investment-oriented one.

EVT Token by Evareium

Along with the issuance of EVM to investors, we are issuing the Evareiumutility token, EVT as a bonus credit to subscribers, which will be created after the EVM ITO. The benefits are generated from their intrinsic value and use as EVTand blockchain technology is incorporated into the real estate assets, essentially the cryptocurrency of the assets leveraging value from rents, and ancillary transactions through the assets. EVT’s value accretion basis is its use and incorporation into real assets’ operations.

To learn more about our Strategy andInitial Token Offering Roadmap please visit the Evareium Homepage, and sign up through our Dashboard.

Author: willi dimuka

No comments:

Post a Comment